If your business had a yearly gross revenue of $2.5 million or less in 2019, you may be eligible to apply for The State of California’s Small Business COVID-19 Relief Grant Program.

If you want to apply, you must pick a partner organization to apply through. You can find the list of partners serving San Francisco county applicants here.

If you have any questions, please refer to this FAQ page. You can also register for webinars through Small Business Development Center to learn more about the application process.

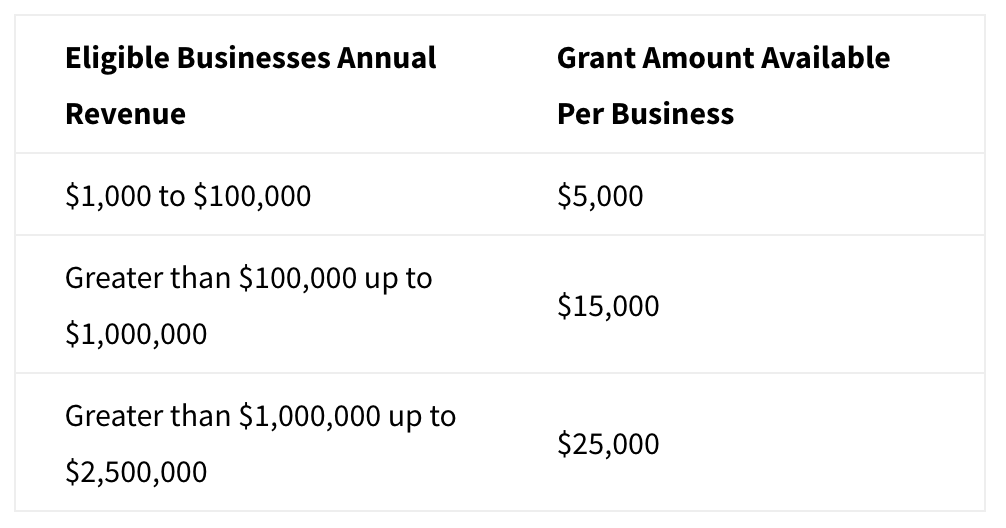

The amount of grant funding ranges from $5,000 to $25,000, depending on what your revenue was in 2019. Businesses are eligible based on their annual revenue as documented in their most recent tax return:

Summary of Eligibility Requirements:

A small business or small nonprofit must satisfy the following criteria to be eligible to receive a grant award:

Must meet the definition of an “eligible small business” that has yearly gross revenue of $2.5 million or less (but at least $1,000 in yearly gross revenue) based on most recently filed tax return) or (ii) a “small nonprofit” (registered 501(c)(3), 501(c)(19), or 501(c)(6) nonprofit entity having yearly gross revenue of $2.5 million or less (but at least $1,000 in yearly gross revenue) based on most recently filed Form 990)

Active businesses or nonprofits operating since at least June 1, 2019

Businesses must currently be operating or have a clear plan to re-open once the State of California permits re-opening of the business

Business must be impacted by COVID-19 and the health and safety restrictions such as business interruptions or business closures incurred as a result of the COVID-19 pandemic

Business must be able to provide organizing documents including 2018 or 2019 tax returns or Form 990s, copy of official filing with the California Secretary of State, if applicable, or local municipality for the business such as one of the following: Articles of Incorporation, Certificate of Organization, Fictitious Name of Registration or Government-Issued Business License

Business must be able to provide acceptable form of government-issued photo ID

Applicants with multiple business entities, franchises, locations, etc. are not eligible for multiple grants and are only allowed to apply once using their eligible small business with the highest revenue